Read time: 5 minutes

Welcome to the Succession newsletter where 1,000+ life science sales reps improve their skills in 5 minutes per week. If you’re getting value from these newsletters, we'd love it if you could forward it along to your sales colleagues. If you’re new here, subscribe below.

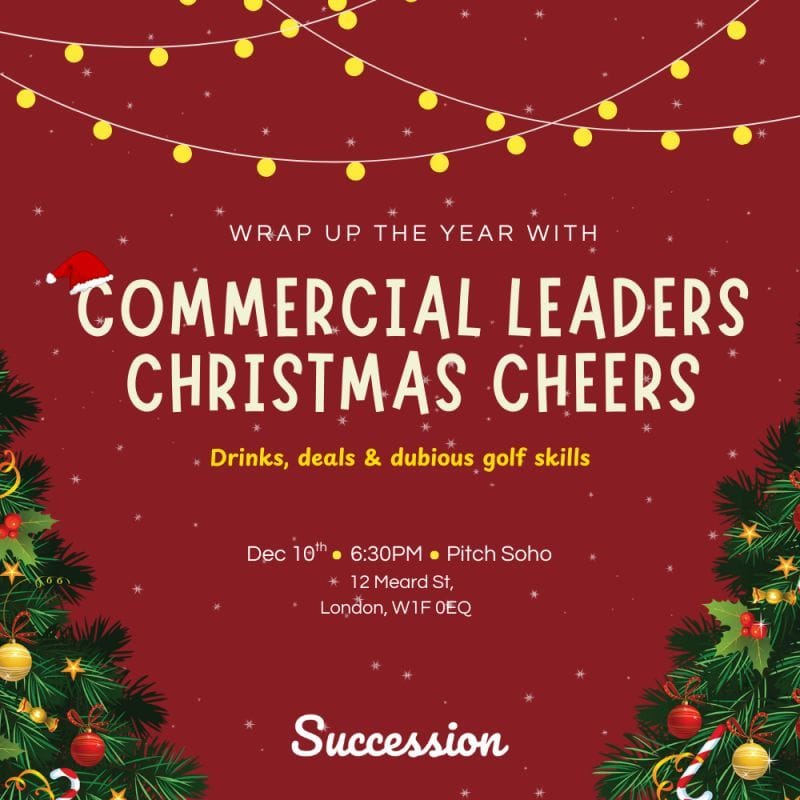

If you're in London on Dec 10, come join the Succession team and other commercial leaders for drinks & some fun on the driving range!

It'll be a great way to network and meet other people in the life sciences.

If you know anyone who might want to join, please forward this along to them.

See you there!

The Real ROI of Cold Outbound (And How to Actually Measure It)

Most teams running cold outbound have no idea if it's “working”.

They track opens. They track replies. Maybe meetings booked.

But ask them what their true cost of acquisition is or how many prospects do you need to contact for every won deal? Blank stares.

To know if your outbound prospecting is working, you need to understand the full math from first contact to closed deal or you're just guessing.

Don’t worry, this isn’t a full newsletter on how to do arithmetic!

Let’s dive into it.

Why Bother With Cold Outbound at All?

Okay so before we get into the math, let's talk about why you'd even do this.

Inbound is great. Someone finds your content, raises their hand, says "I'm interested." The intent is there and the timing is right.

But with inbound, you're at the mercy of whoever happens to find you. They might be qualified. They might not. You have basically zero control over who shows up. You're just... waiting for the right people to stumble onto your website. As a rep, this is often outside of your control. So waiting for marketing “leads” can’t be your strategy.

Cold outbound gives you full control.

You can target the EXACT people or companies you want. You pick the titles. You pick the company size. You pick the application/use case.

I like to think of cold email as a perfectly crafted ad put in front of the exact person you want to reach. With paid ads, you're stuck with whatever targeting LinkedIn or Google gives you. And your messaging has to be generic enough to work for a broad audience.

Cold email? You can write a message specifically for the VP of Regulatory Affairs at a Series B biotech who just announced a Phase 2 trial. Try doing that with a LinkedIn ad.

And there's another benefit that people miss. Cold outbound is incredible for testing messaging. If you can get someone who has never heard of you to reply to a cold message, you know you've found something that actually resonates. That's signal you can't get from inbound where people already know who you are.

Why Measuring Cold Outbound Is Harder

Cold outbound is just messier to measure than inbound.

With inbound, someone fills out a form, you close them, you know exactly what drove the deal. Clean attribution.

Cold is different. You're contacting people who've never heard of you. The sales cycle is longer because you need to build trust from zero. And the win rate is almost always lower than inbound because cold prospects need more proof before they buy.

Outbound can also drive inbound. If I email someone, they go to the website and convert, your attribution system is likely giving credit to the website vs the outbound message.

In the above example this might show up as branded search traffic or direct traffic which might lead your team to think “we should double down on SEO since it’s working!”

When in reality, it’s your outbound campaigns driving a lot of that traffic.

The trick is to measure each and every touchpoint across channels and not “attribute” revenue to ONE channel.

The Metrics You Actually Need to Track

Let me walk through each one.

Open Rate and click rate?

Stop tracking open and click rates. More on that here: https://blog.succession.bio/p/dont-track-open-rates

Reply Rate

Reply rate is your best indication of deliverability and makeing sure your messages are landing in an inbox vs spam or promotions. The ratio of reply to positive replies will also give you a good indication of if you’re messaging the right people with the right message.

Positive Reply Rate

Not just any reply. Positive replies. "Thanks but not interested" doesn't count. You need replies that can actually lead somewhere.

Benchmark: 30-40% positive reply rate for cold email is solid. LinkedIn sits a bit higher at 40-50%. If you're below 20%, your messaging or targeting needs work.

Meeting Booked Rate

Of those positive replies, how many turn into actual meetings? A good conversion here is 30-50%. If people are responding positively but not booking, your follow-up or meeting ask might be the issue.

Meeting to Opportunity Conversion

Not every meeting becomes a real opportunity. Some are bad fits. Some are just "exploratory" calls that go nowhere. Track what percentage turn into qualified opportunities. This tells you how well your targeting is working upstream.

Win Rate

This is the % of deals you win vs lose. (if you never “close lost” deals, because you hope they will close later, you’ll have an inflated win rate").

For every 4 opps created, you win 1; that is a 25% win rate.

There are 2 very different win rate numbers you need to track. 1: Win rates from inbound leads. 2: Win rates from outbound leads.

Outbound leads are harder to close because they don’t know who you are and you have to educate and build trust from scratch! So it’s only logical to know you can’t simply apply your inbound win rate to your outbound sales motion.

Average Order Value

Your deal size determines whether the math works at all. A $5,000 deal and a $50,000 deal require completely different volume to hit the same revenue target. Pretty obvious but people forget this.

Customer Lifetime Value

First-order ROI might look marginal. But if your customers stick around and expand, lifetime ROI tells the real story. This is especially true in life sciences where relationships compound over years.

The Simple CAC Formula

Here's the math portion...

If you know your cost per opportunity, you can calculate your cost of acquisition by just dividing by your win rate.

Example:

Monthly outbound spend: $5,000

Opportunities created: 5

Cost per opportunity: $1,000

Win rate: 25% (1 in 4)

Cost of Acquisition: $4,000 (that's cost per opp × 4)

That's it. Your CAC is your cost per opportunity divided by your win rate. Or said another way. If you win 1 in 4 opportunities, just multiply your cost per opportunity by 4.

If your average deal is $25,000 and your CAC is $4,000, your first-order ROI looks pretty solid. Factor in lifetime value and it gets even better.

First Order vs Lifetime ROI

This distinction matters more than most people realize.

First Order ROI = (First deal revenue - Acquisition cost) / Acquisition cost

If you spend $4,000 to acquire a customer who spends $6,000 on their first order, your first-order ROI is 50%. Decent but not amazing.

Lifetime ROI = (Total customer value - Acquisition cost) / Acquisition cost

If that same customer spends $50,000 over 3 years, your lifetime ROI is 1,150%.

Companies with strong retention and expansion can afford higher acquisition costs. Companies with one-time purchases need first-order profitability.

Working Backwards From Your Target

One of the most useful things you can do is calculate how many contacts you need to hit your revenue target.

Say you need to close 2 deals per month. Working backwards:

Need 2 deals

At 25% win rate → need 8 opportunities

At 50% meeting-to-opp rate → need 16 meetings

At 30% reply-to-meeting rate → need 53 positive replies

At 5% positive reply rate → need about 1,067 contacts per month

Now you know exactly how much volume you need.

If your market only has 500 relevant contacts, you have a problem. Either your conversion rates need to improve dramatically, or outbound alone won't hit your target.

The Sales Cycle Problem

Here's something most teams don't think about.

If you have a 6+ month sales cycle, you literally cannot measure true ROI until at least a full cycle has passed (probably more since outbound deals take longer to close).

You launch outbound in January. Book meetings in February. Create opportunities in March. But deals don't close until September or October.

If you're looking at your outbound ROI in April and seeing no revenue, that's not failure. That's just physics. The deals haven't had time to close yet.

In the example above, you need to start outbound in January to close deals in Q4!

This is something I’ve seen dozens of teams fail to understand… So if you don’t understand your sales cycle, how can you possibly plan activities appropriately?

In the meantime, this is why you need to track leading indicators while you wait for the lagging ones. Reply rates (are people engaging?), meeting rates (is engagement converting?), opportunity creation (is pipeline building?), pipeline value (what's the potential revenue?).

You can forecast projected ROI based on pipeline value × win rate. Not perfect, but way better than flying blind.

Hidden Costs People Miss

When calculating your all-in outbound cost, include everything.

Personnel: SDR/sales rep salary, commission, benefits.

Data: contact databases, enrichment tools, verification.

Events: events reps attend, travel, hotels.

Infrastructure: email sending tools, CRM, dialers, LinkedIn Sales Navigator.

AI costs: tokens, prompts, analysis.

Management overhead: time spent reviewing, coaching, reporting.

A super common mistake is only counting the obvious stuff (software + data) and ignoring labor. If your SDR costs $6,000/month fully loaded and your tools cost $500/month, your real monthly spend is $6,500/SDR. Not $500.

Also - if you have sales reps who are doing their own outbound, some portion of their salary needs to be included in the equation.

If you’re looking for a more affordable way to scale outbound where you get access to everything above for less than the cost of 1 person’s salary, Succession can help!

Variability Is Real

Not all activity is created equal.

One rep might book 15 meetings from 1,000 contacts. Another books 3 from the same list. Same volume. Wildly different outcomes.

This variability makes benchmarking tricky. You need to track metrics at the rep level, identify what top performers do differently, then standardize and train on winning patterns.

Campaigns vary too. Finding message-market fit in cold outbound is harder than in sales conversations because you don't get real-time feedback. You're testing in the dark basically.

Run smaller tests before scaling. Don't blast 10,000 contacts with messaging you haven't validated.

The Timing Thing

Here's something that trips up a lot of teams.

Not everyone is in the market right now.

You might contact the perfect prospect with the perfect message. But if they just signed a contract with a competitor last month, timing kills the deal. Doesn't matter how good your outreach was.

This doesn't mean your outbound failed. It means they aren’t ready.

The mistake is running one campaign, seeing bad results, and giving up.

Cold outbound is a long game. And it is a numbers game.

You need to keep going back to your lists with different angles and value props over an extended period. The person who ignores you in January might respond in June when their situation changes. The company that wasn't a fit last quarter might have a new initiative this quarter.

This is why persistence and iteration matter so much. You're not just testing one message, you're testing multiple messages across multiple time windows until you find what works.

What you don’t want to hear…

Here's the hard truth about cold outbound.

Success ultimately comes down to whether people want the product or service you're putting in front of them.

Great products outperform commodities. Must-haves outperform nice-to-haves. No amount of clever copywriting will overcome a weak value proposition.

But the good news is, cold email is one of the best ways to test this.

When you reach out to your total addressable market and genuinely offer something valuable, you find out fast whether people care. Positive replies are validation. Crickets are feedback.

If you're contacting the right people with clear messaging and getting zero engagement, that's not just an outbound problem. That's a product-market fit signal.

Cold outbound lets you reach your entire total addressable market and answer the fundamental question. “Do we have something people actually want?”

That clarity alone is worth the investment. Even before you count the deals.

Tools That Help

We've built a few things to make this easier:

Quota Calculator — Plug in your conversion rates and deal size to see exactly how much activity you need to hit quota. Works backwards from revenue to give you daily/weekly targets.

Email Finder — Find contact info for free or cheap after you've burned through your trial credits on the big platforms. Good data is the foundation of everything.

Email Grader — Get instant feedback on your cold email copy. Helps you write messages that actually get replies.

Want Help With This?

If this feels like a lot, or you just want to skip the learning curve, Succession can help.

We build and run cold outbound campaigns for life science companies. We handle targeting, messaging, infrastructure, and optimization. You get meetings on your calendar with qualified prospects.

Reach out if you want to talk about what's possible for your market.

Episode 76: [Sales] Breaking through the status quo with Jen Allen-Knuth

We're finishing off our women in sales takeover on a high! We get Jen's take on exactly what the buyer status quo is, how to structure your outreach to be more buyer-centric, and align your message to meaningful business goals. Between the laughs, there's lots of really valuable tips that you can act on right now, so get listening!

Lead Generation: We’ll build target lists, write scientifically relevant messaging, and send messages on your behalf to book qualified sales meetings with biotech and pharma companies.

Training for Reps: A skill development platform for life science sales reps who want to improve their sales skills, exceed their quota, and take the next step in their career.

Training for Teams: If you want to upskill your team around prospecting, driving to close, key account management, AI, or any other topic, we can put together a training plan specific to your organization’s needs.

Strategy Call: Need more than training? Want help implementing and executing your sales strategy? In a 30-minute call, we will assess your company’s current situation and identify growth opportunities.